ALBERTA’S PROSPERITY SCORECARD:

AREAS OF PROGRESS AND PRESSURE HALFWAY THROUGH THE DECADE

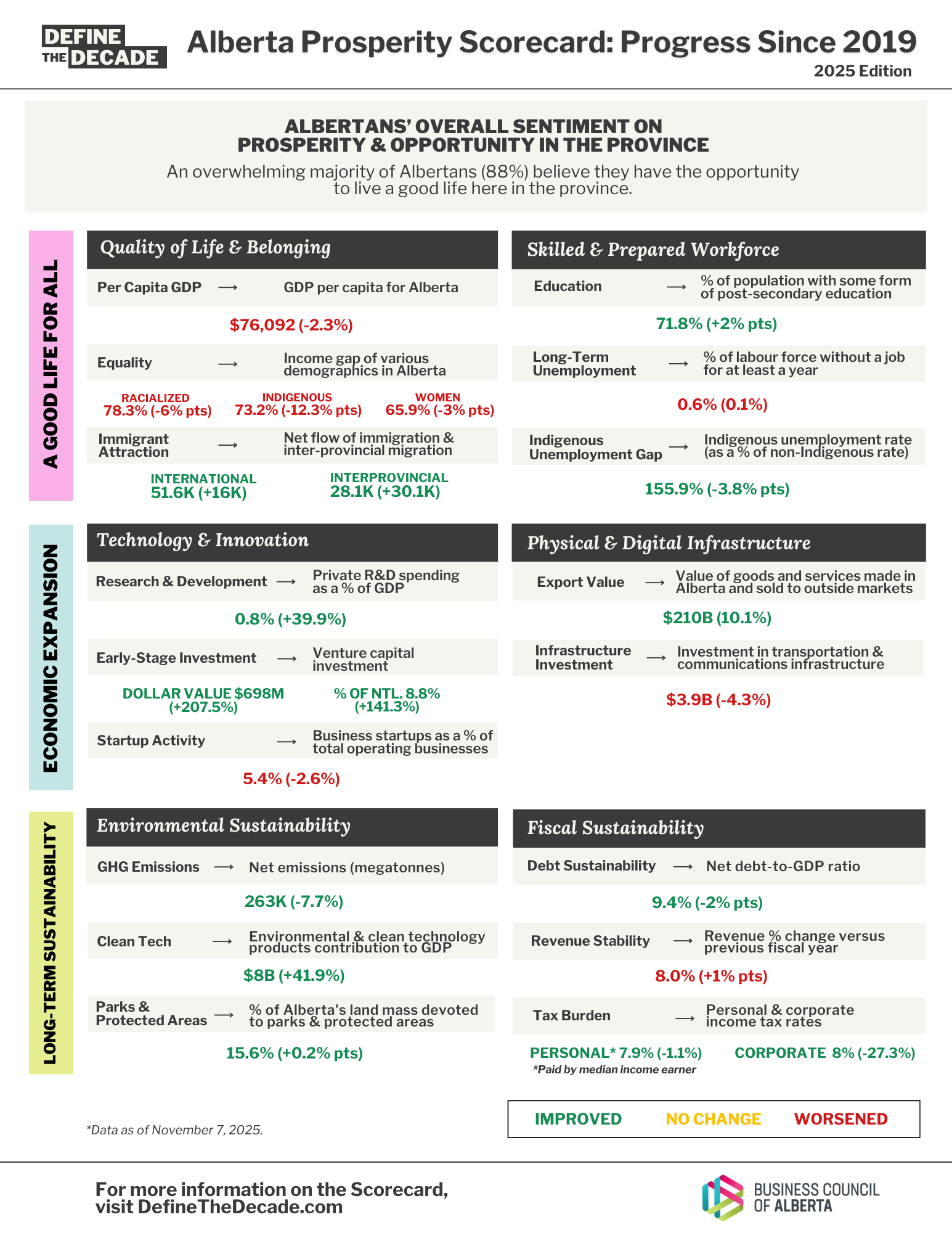

The 2025 Prosperity Scorecard is more than a single-year snapshot. It reviews Alberta’s progress from 2019 to 2025, an assessment of how the province is performing — halfway through the decade — across 22 measures of prosperity, from economic strength and innovation to quality of life and belonging. The Scorecard highlights where Alberta is making gains, where it is falling behind, and where focused action will be essential to ensure long-term prosperity for all Albertans.

This Scorecard underlines both progress and pressure, offering a clear view of where collective effort and targeted policy support will be needed to ensure prosperity is shared by all Albertans.

HIGHLIGHTS FROM THE 2025 SCORECARD

Surging venture capital investment, declining emissions, and a narrowing Indigenous employment gap highlight Alberta’s strengths, while lagging GDP growth, infrastructure pressures, and widening income disparities underline the need for urgent, targeted action.

A Good Life:

This year, 88% of Albertans say they have the chance to live a good life — up from 82% in 2024.

*Sources: Janet Brown Omnibus Survey, October 2025 & Business Council of Alberta, Scorecard Data, November 2025

AREAS OF PROGRESS

- Indigenous Employment Gap: The unemployment gap between Indigenous and non-Indigenous workers has narrowed by 3.8% points. While this marks progress, Indigenous unemployment remains high—10.6% versus 6.8% for non-Indigenous workers — highlighting the need for continued targeted initiatives to support economic inclusion.

- Venture Capital Investment: Alberta’s share of national venture capital investment has more than doubled: from 3.7% in 2019 to 8.8% most recently. The growth signals that the province has become a leading destination for innovation-driven investment.

- GHG Emissions: Overall emissions have fallen by 7.7% since 2019, even as energy production has continued to grow. Oil and gas emissions remain flat, and those in electricity have declined.

AREAS OF OPPORTUNITY

- GDP Per Capita: A 2.3% decrease in GDP per capita reflects economic growth not keeping pace with Alberta’s population increase. Sustained efforts will be crucial to maintaining the province’s attractiveness for residents, businesses, and investors.

- Infrastructure Investment: Alberta’s investment in transportation and communications infrastructure has stagnated while the province’s population has grown considerably, putting more pressure on existing systems. Ensuring that Alberta has sufficient and high-quality infrastructure is essential to connecting people and enabling economic growth enables the movement of goods and people across the

- Income Disparity: Income gaps for racialized people, Indigenous peoples, and women have widened, pointing to ongoing barriers to full participation in Alberta’s economy and the need for more targeted policy support.

Background:

In 2022, the Business Council of Alberta (BCA) launched its Define the Decade initiative, a 10-year prosperity vision for the province and an economic development strategy to help get us there. As part of this work, we committed to regularly tracking Alberta’s progress toward that vision by measuring key indicators of economic and social wellbeing through our yearly Prosperity Scorecard.

Why? Because what gets measured gets done, and because understanding where we are today helps us develop the blueprint for how to build a better Alberta.

In the annual Prosperity Scorecard, BCA’s Policy and Economics team reviews the areas in which the province is improving or worsening, using the most recently available data.